Advisor

Registered Investment Advisors

Our turnkey custody solution helps advisors build a competitive advantage, manage their business with efficiency and serve clients at lower cost.*

The IBKR Advantage

- No ticket charges, no custodial fees, no minimums and no technology, software, platform or reporting fees.

- IBKR does not have an advisory team or a prop trading group to compete with you for clients.

- We provide a low-cost global trading and custody solution to advisors of all sizes.

- Trade stocks, options, futures, currencies, bonds and funds on over 50+ markets

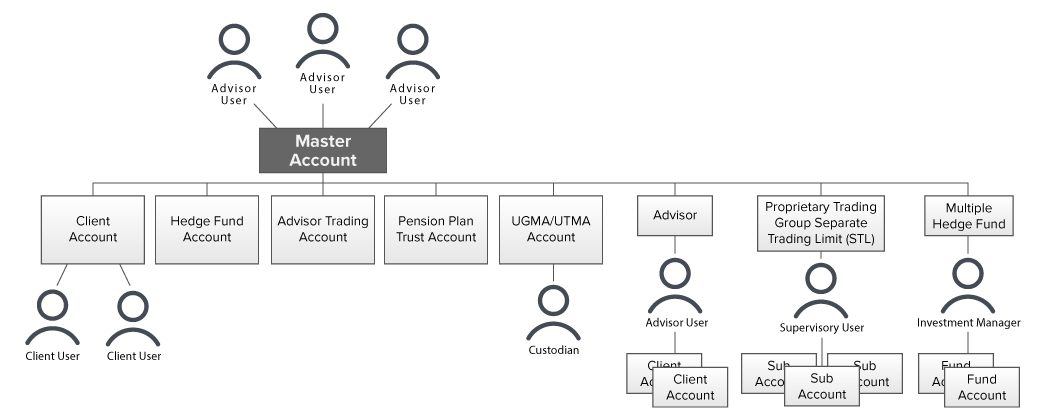

from a single integrated master account. - Free CRM, portfolio management and trading platform, plus PortfolioAnalyst®, a tool to consolidate your clients’ entire portfolio.

- Automated and flexible client billing.

- Free website building services.

Professional Pricing - Maximize Your Returns

Low commissions with no added spreads, ticket charges or platform fees. If an exchange provides a rebate, we pass some or all of the savings directly back to you.*

Learn About CommissionsTiered commission rates based on activity.

Learn About Pricing*For more information, see our disclaimers.

Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

Technology to Help Advisors Succeed

Trading Platforms

Powerful, award-winning trading platforms and tools for managing client assets. Available on desktop, mobile, web and API.

Goal Tracker

Goal Tracker projects the hypothetical performance of a portfolio and monitors how likely you are to achieve your goals.

Order Types and Algos

100+ order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

Advisor Tools

Spot market opportunities, analyze results, manage your account and make informed decisions with our free advisor tools.

Pre-Trade Allocations

Use IBKR’s pre-trade allocations to allocate block trades to multiple accounts with a single mouse click.

Allocation Order Tool

Transform and streamline the creation, execution and allocation of group orders. Develop and deploy investment strategies in minutes to capture opportunities in volatile markets.

Create Client-Centric Investment Portfolios

Environmental, Social and Governance (ESG)

ESG scores from Refinitiv give you and your clients a new set of tools for making investment decisions based on more than just financial factors.

Impact Dashboard

Use the Impact Dashboard to identify and invest in companies that share the values held by your clients.

IBKR Client Risk Profile

Use the IBKR Client Risk Profile to understand client risk tolerances and recommend suitable investments for your clients.

ESG Impact Profile

Use the ESG Impact Profile to understand client preferences related to socially responsible and impact investing.

Spend Your Time on Your Clients

with Investment Models

Streamline your workflow by investing your client assets with Model Portfolios.

Establish a portfolio of financial instruments, and then trade this model on

behalf of your clients.

- Set target percentage allocations

- Invest all or a portion of clients’ funds into the model

- View and track model performance

| Browse over 70 low-cost, well-diversified portfolios |

Use our free advisor tools to create your own models |

||

|---|---|---|---|

|

We have 3 easy ways to get started with Models

|

Interactive AdvisorsTM |

Models by recognized institutions |

Symbol by Symbol |

|

How it works |

Select from 50+ portfolios in various styles such as Smart Beta, ESG, Asset Allocation and more. |

Select from top-tier vendor models designed by Cambria Investments, WisdomTree, John Hancock Investment Management, Global X, AGFiQ and many more. |

Build your model symbol-by-symbol. You have customized controls with advanced tools to manage and rebalance your investments. |

|

Ease of use |

|

|

|

|

Customization |

|

|

|

|

Exclude Certain Stocks |

|||

|

Rebalance Reminders |

|||

|

Auto-Rebalancing |

|||

|

Cost and Fees |

USD 0.01 to 1.00 |

USD 0.01 to 1.00 |

USD 0.00 |

| Browse IA Models | Browse Vendor Models | Learn More | |

| Browse over 70 low-cost, well-diversified portfolios |

|

|---|---|

Interactive AdvisorsTM |

Models by recognized institutions |

|

Select from 50+ portfolios in various styles such as Smart Beta, ESG, Asset Allocation and more. |

Select from top-tier vendor models designed by Cambria Investments, WisdomTree, John Hancock Investment Management, Global X, AGFiQ and many more. |

| Browse IA Models | Browse Vendor Models |

| Use our free advisor tools to create your own models |

|---|

Symbol by Symbol |

|

Build your model symbol-by-symbol. You have customized controls with advanced tools to manage and rebalance your investments. |

| Learn More |

Advisor Portal

A free and powerful client relationship management (CRM) platform

for advisors on the IBKR platform.

Integrated Client Management

Manage the full client acquisition and relationship lifecycle, use a Client Risk Profile tool to understand client risk tolerances and administer each client account.

Efficient Design

Use simplified workflows, logically grouped menus and user access rights to efficiently manage your relationships from any desktop or mobile device.

Reliable Client Onboarding Processes

IBKR offers multiple options for adding clients and migrating to our platform, including a mass upload feature and support for customized client account applications using our application XML system.

Manage User Access Rights

Create one or more Security Officers for the master account and designate up to 250 users by function or account.