Invest for Your Future with a Stocks and Shares NISA

Minimize Your Costs to Maximize Your Returns

Invest for the Future with a Nippon Individual Savings Account (NISA)

Not a Client?

Already a Client?

Add NISAsThe IBSJ Advantage

- Low Commissions: No commissions on domestic mutual funds. Tiered pricing for stocks starts at 0.05% of trade value, fixed pricing starts at 0.08% of trade value, and USD stocks start at just USD 0.005 per share.

- Portfolio Diversification: Choose from a broad offering of investments, including a selection of domestic mutual funds and global stocks from exchanges such as NYSE, NASDAQ, LSE and HKEX.

- Mobile Trading: Trading is straightforward with our mobile smartphone app, available for Android and iPhone.

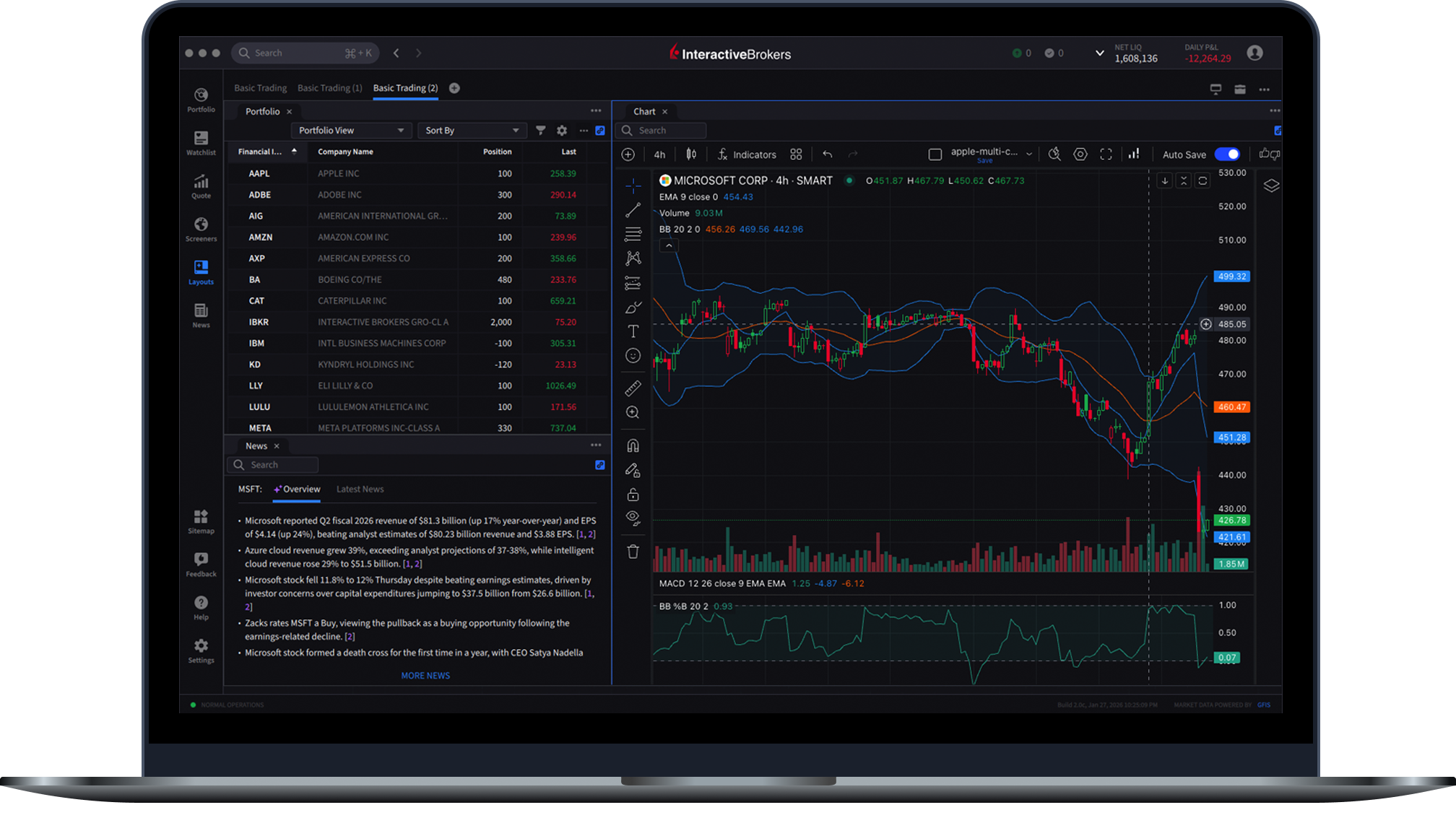

- Powerful Trading Tools: Our feature-rich trading platforms meet the needs of both the occasional investor and active trader.

About NISAs

NISAs are a tax-advantaged account that can help Japanese residents acquire wealth. Unlike a regular investment account, capital gains and dividends from investments held in a NISA are tax-exempt. The lifetime combined investment limit for NISAs is JPY 18,000,000.

A NISA at Interactive Brokers include a general investment account, a Seicho NISA and Tsumitate NISA.

Tsumitate NISA

If you are an investor with a lower risk appetite and a longer-term investment horizon, the Tsumitate NISA allows you to invest in pre-approved, lower risk mutual funds that are approved by the FSA. The Tsumitate NISA is limited to recurring monthly orders with a monetary amount, has a yearly investment limit of JPY 1,200,000 (JPY 100,000 per month). However, you can only invest up to 18,000,000 between both NISA accounts. The minimum investment for a Tsumitate NISA is JPY 10,000 and the minimum sale is one mutual fund unit.

Seicho NISA

If you are an investor with a higher risk appetite and desire for higher returns, a Seicho NISA lets you work toward your objectives by investing in domestic or foreign stocks as well as ETFs and mutual funds. You can buy or sell your investments at any time and have a yearly investment limit of JPY 2,400,000 and lifetime investment limit of JPY 12,000,000. The minimum investment for a Seicho NISA is JPY 10,000 and the minimum sale is one unit of stock, ETF, or mutual fund.

General Investment Account (GIA)

Invest globally in stocks, options, futures and CFDs from a single integrated account. Fund your account in JPY, USD, EUR and GBP and trade assets denominated in multiple currencies.

Account Type

| NISA account-Tsumitate | NISA account-Seicho | GIA | |

|---|---|---|---|

| Yearly Contribution Cap (JPY) | 1,200,000 | 2,400,000 | N/A |

| Maximum Lifetime Contribution Cap (JPY) | 18,000,000 combined (12,000,000 in NISA account-Seicho) |

N/A | |

| Available Products | Approved MF | Listed stock, ETF, MF | Listed foreign and domestic securities, ETF, CFDs, Listed futures and derivatives |

Not a Client?

Already a Client?

Add NISAsFor more details about NISA accounts, please click this link.

Funding NISA Accounts

Your Bank

Deposit

into GIA

Withdrawal

from GIA

General Investment Account (GIA)

Funds Auto Sweep

Funds Auto Sweep

Tsumitate NISA Account

(A-NISA)

Seicho NISA Account

(G-NISA)

Important

- Only general investment accounts (GIA) can hold cash balances or perform deposit/withdrawal transactions.

- NISA accounts cannot hold cash balances. Instead, cash is swept from the GIA when a trade is executed. Cash from payments or closing of NISA positions are swept from a NISA account into a GIA's cash balance.

- When trading, the order ticket allows traders to choose which account to trade on. Please be sure you are selecting the correct account prior to submitting your order.

Note:

To fund your account, please create a matching deposit notification on your general investment account (GIA) in Client Portal: Transfer & Pay > Transfer Funds > Deposit Funds.

Under the new NISA system, when assets held within your NISA account are sold the average price you paid for the asset is added back to your available lifetime contribution limit in the following calendar year. In addition, actions such as mutual fund dividend payments may also result in the recovery of investment limits.

This means you can reinvest the average price of the initial investment amount or dividend payment amount without exceeding your lifetime limit, though the annual contribution limit of JPY 3,600,000 still applies.

If you ever exceed your annual contribution limit, the contribution excess is routed to your GIA and becomes taxable.

You can only open one NISA account (growth and/or accumulation) at one broker per fiscal year. The procedures for changing your NISA broker to IBSJ are listed below. All profits and losses in NISA accounts are tax-free for Japanese products. However, overseas taxes may apply for some overseas (non-Japanese) products.

Only dividends delivered into your NISA brokerage account are tax-free.

If you want to change your NISA provider and transfer your NISA to IBSJ, you must complete your application by 15 September.

If you have not used your NISA at your current broker this year, you may begin using your new NISA at IBSJ before year-end. If you have already used your NISA at your current broker this year, you will need to wait until 1 January of the following year before switching your NISA provider to IBSJ.

If you would like to make IBSJ your NISA provider, we require:

- Either the Kanjohaishisho (Notice of Account Discontinuance) or Hikazeikozahaishisho (Notice of NISA Account Closure) you received from your current NISA provider

- Account and Transaction Statements for your current NISA account.

Mutual Fund Distributions

There are two types of distributions for Mutual Funds: Ordinary Distributions and Principal Distributions (aka “Special” Distributions).

The type of distribution depends on your own unrealized PL, and they have different tax treatments as well. Depending on the NAV at which you subscribed to the fund, the NAV at the time of distribution, and the distribution size, some or all of the distribution may be considered taxable profit and/or may reduce your investment principal.

Ordinary Distributions

These are paid out of trading profits/dividends/interest/etc. If the NAV after distribution is equal to or greater than your principal, then the entire distribution is considered Ordinary and is taxable as dividend income.

Principal Distributions

These are paid as a cash distribution by partially reducing your principal amount. If the NAV after a distribution is less than your principal, it is considered a refund of principal; your principal will be reduced, and the distribution is not taxable as it is not considered “profit.”

IBJS does not allow Mutual Fund switching. NISA is a long-term investment vehicle primarily for buy-and-hold.

If you want to unsubscribe from one Mutual Fund and subscribe to another, please do so in accordance with your long-term investment strategy. Also, please note the impact on your monthly, yearly, and lifetime NISA investment limits.

Experience Professional Pricing1

- Japanese mutual funds are available commission free, with low commissions on other products and no added spreads, ticket charges or platform fees.

- IBKR BestXSM is a powerful suite of advanced trading technologies designed to help clients achieve best execution and maximize price improvement while minimizing market impact.

- Tiered and fixed commission rates based on activity.

Global Market Access – Discover More Opportunities

Clients can use their NISA to access a broad offering of investments, including a growing selection of domestic mutual funds and global stocks from exchanges such as NYSE, NASDAQ, LSE and DAX.

Fund your brokerage account and trade assets in global currencies.

Fractional shares let you divide your brokerage account investments and Seicho NISA non-Japanese stocks among more stocks to achieve a more diversified portfolio.

Powerful Trading Platforms To Help You Succeed

Award winning platforms for every investor from beginner to advanced on mobile, web and desktop.

A full suite of order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

Open a Broker Account

with NISAs

Already

a Client?

Disclosures

Mutual Funds are investments that pool the funds of investors to purchase a range of securities to meet specified objectives, such as growth, income or both. Investors are reminded to consider the various objectives, fees, and other risks associated with investing in mutual funds. Please read the prospectus accordingly. This communication is not to be construed as a recommendation, solicitation or promotion of any specific fund, or family of funds. Interactive Brokers may receive compensation from fund companies in connection with purchases and holdings of mutual fund shares. Such compensation is paid out of the funds’ assets. However, IBKR does not solicit you to invest in specific funds and does not recommend specific funds or any other products to you. For additional information please view our Mutual Fund Product Listings.

Mutual funds trade once per day. Each fund has a cut off time, after which an instruction to buy or sell cannot go through until the next day. Any attempt that you make to cancel or modify an order will be considered a request to cancel or modify that order. We will do our best to meet your request but cannot guarantee that your order can be changed or cancelled, even where the request is submitted before the cut off time. We shall not be liable to you if we are unable to cancel or modify an order. You remain responsible for executions even where you have made a request to cancel or modify an order.

- All commissions and fees include the 10% Japanese consumption tax.