Products Stock Trading

PRODUCTS

Trade Stocks Globally from a

Single Screen

The IBKR Advantage

- Low Commissions with no added spreads, ticket charges or platform fees.

- Trade stocks globally on 50+ market centers

- Professional trading platforms, mobile apps, order types, and tools

- Fractional Shares let you invest regardless of share price

Lower Costs to Maximize Returns1

US Exchange-Listed Stocks Commissions

Low Commissions

USD 0.0005 to USD 0.0035 per share

Tiered or Fixed • No PFOF

Trading Technology

- Free Access to all IBKR's trading platforms

- Free real-time streaming data on all US-listed stocks

- IB SmartRoutingSM

- IBKR APIs

Additional Plan Benefits

- No minimums for general investment accounts

- No inactivity fees

- No added spreads, ticket charges or platform fees

- No recurring fees

IB SmartRoutingSM helps support best execution by searching for the best available prices for stocks, options and combinations across exchanges and dark pools.

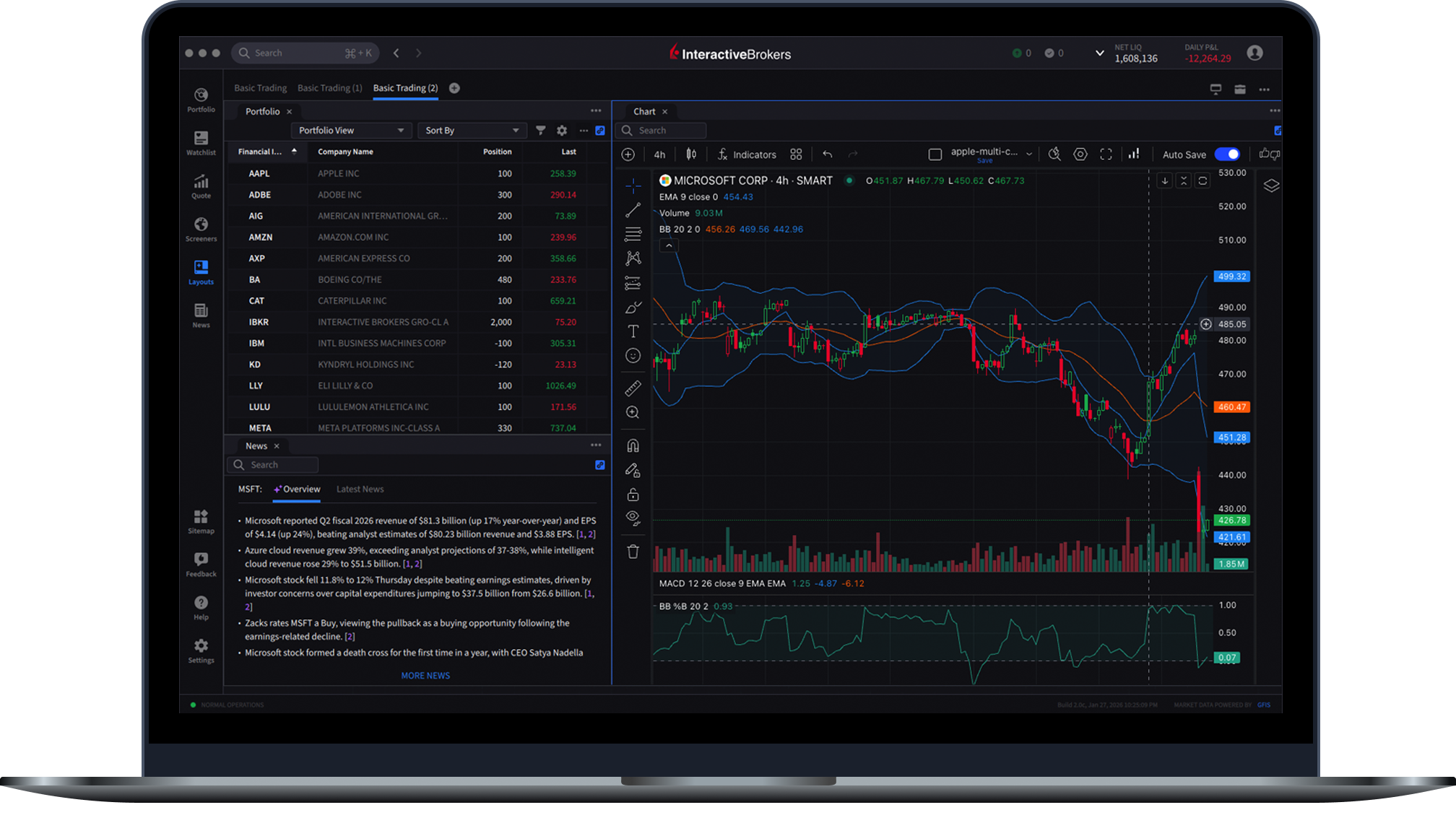

Professional Trading Platforms, Order Types, and Tools

Powerful, award-winning trading platforms and tools for managing your portfolio. Available on desktop, mobile apps, and web.

See Our Trading Platforms80+ order types, algos and tools – from limit orders to complex algorithmic trading – help you execute any trading strategy.

See Our Order Types, Algos and ToolsUse a full suite of professional trading tools to help make better decisions and manage your portfolio. Spot market opportunities with Advanced Market Scanners and analyze your portfolio with Risk Navigator.

See Our Trading ToolsFundamentals Explorer provides comprehensive, worldwide fundamentals data on over 30k companies, shows more than 300 data points per company, has more than 80 sources for newswires and reports and features 5.5k+ analyst ratings from TipRanks.

See Our Fundamentals ExplorerAlign your investments with what you care about most. Use the Impact Dashboard to identify and invest in companies that share your values, and use ESG scores from LSEG to make investment decisions based on more than just financial factors.

Learn About Sustainable InvestingWhat are Stocks?

A stock represents ownership in a company. When you purchase a stock, you become a shareholder and own a small portion of the company issuing the stock. Therefore, you have a claim on its assets and earnings.

A company typically issues stock to raise capital to fund growth, research and development, or its operations without taking on debt.

The two main types of stock are common stock, which typically provides you with voting rights and potential dividends, and preferred stock, which usually provides fixed dividends and priority over common shareholders in the unlikely event of a liquidation.

How Do You Buy Stocks?

You can purchase stocks through an online brokerage account like those available at Interactive Brokers or through a financial advisor. If you use an online brokerage account, you can place buy or sell orders for stock through the broker’s platform after your account is approved and funded.

Stocks are bought and sold at a stock exchange, such as the New York Stock Exchange (NYSE), the NASDAQ, the London Stock Exchange (LSE), Euronext or the Shanghai Stock Exchange.

What Are the Risks and Rewards of Stocks?

A stock’s price can be volatile, meaning the value of your stock may rise or fall significantly, even over short periods. There are no guarantees in stock investing. You may lose money if the price of a stock drops below your purchase price and you sell at a loss. In addition, you can also experience losses from a company’s bankruptcy, poor earnings or broader market factors such as industry or economic trends, interest rate changes, geopolitical events or investor sentiment.

However, if a stock’s price increases over time, you may benefit from capital appreciation and earn dividend income from companies that share profits with their owners. Dividends can provide a steady income stream and, if reinvested, may help you enhance longer-term returns.

Interactive Brokers’ Education and Resources for Stocks

Traders’ Academy

Traders’ Academy by Interactive Brokers provides complimentary resources to educate you on stocks, including several courses on corporate stocks and equity-related funds.

Traders’ Insight

Traders’ Insight provides market-related articles and commentary from Interactive Brokers’ employees, exchanges and third-party contributors.

Start trading like a professional today!

Open AccountDisclosures

- Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.