Interactive Brokers Home

Award Winning Platform & Services

Interactive Brokers Securities Japan is a subsidiary of Interactive Brokers Group.

#1 Professional Trading

#1 International Trading

Best Online Broker,

for Advanced Traders

#1 Best Online Broker

5 out of 5 stars

Best for

Advanced Traders

Best Online Broker

Experience Professional Pricing

- Low commissions with no added spreads, ticket charges or platform fees.

- IBKR BestXSM is a powerful suite of advanced trading technologies designed to help clients achieve best execution and maximize price improvement while minimizing market impact.

- Tiered commission rates based on activity.

Japanese Clients Discover a World of Opportunities

Invest globally in stocks, options, futures and CFDs from a single integrated account. Fund your account in JPY, USD, EUR and GBP and trade assets denominated in multiple currencies. Access market data 24 hours a day and six days a week.

50+

Markets

18

Countries

14

Currencies

Learn More

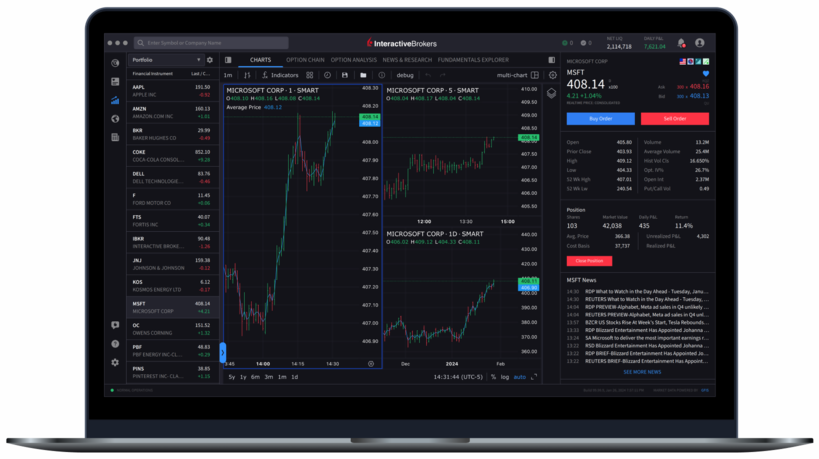

Powerful Trading Platforms To Help You Succeed

Award winning platforms for every investor from beginner to advanced on mobile, web and desktop.

A full suite of order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

A Broker You Can Trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times in the broader financial markets. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR from major market events that can threaten the stability of financial institutions.

Interactive Brokers Securities Japan is a subsidiary of Interactive Brokers Group.

Member of the

S&P 500

Nasdaq Listed: IBKR

$19.5B

Equity Capital*

74.6%

Privately Held*

$13.3B

Excess Regulatory Capital*

4.13M

Client Accounts*

3.62M

Daily Avg Revenue Trades*

IBKR Protection

*Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section.

Choose the Best Account Type for You

Step 1

Open Your Account

It completes all on-line.

Step 2

Fund Your Account

Connect your bank or

transfer an account

Step 3

Get Started Trading

Take your investing to

the next level

- Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section by clicking here.

- "Interactive Brokers Group" and "IBKR" include all Group operating subsidiaries.

Individual Accounts

Individual Accounts Proprietary Trading Group Accounts

Proprietary Trading Group Accounts Small Business

Small Business Compliance Officer Accounts

Compliance Officer Accounts Institutional Accounts

Institutional Accounts