Contracts for Difference (CFDs)

PRODUCTS

Trade Contract for Difference (CFDs)

Use leverage to trade Japanese, US and Global shares

The IBKR Advantage

- Transparent, low commissions and financing rates

- Trade CFD Shares on Japanese, US and Global shares

- Margin requirements generally more favorable than those of shares

IB Share CFDs

Trade CFDs on over 3,500 US stocks and ETFs, Japanese shares and Global shares.

Benefits include:

Transparent, Low Commissions and Financing Rates

Commissions for US Share CFDs start at just USD 0.005 per share, and Japan Share CFDs begin at 0.03% of trade value. Singapore Share CFDs start at 0.11% of trade value, and other share CFDs, including Hong Kong, Europe, and Australia, start at 0.05%.

Overnight financing charges start at benchmark +/-1.5%, with lower spreads available for larger balances. You will find these rates highly competitive. In addition, UK Stamp Duty, French FTT and Spanish FTT are not payable for CFD transactions.

View CFDs CommissionsMargin Requirement

Use leverage to trade more shares with less capital.

The margin ratio applied to CFD transactions will be 22% for individual clients and 12.5% for corporate clients for the initial margin and 20% for individual clients and 10% for corporate clients for maintenance margin.

IBKR Share CFDs FAQs

FAQs: IBKR Share CFDs

Powerful CFD Trading Tools

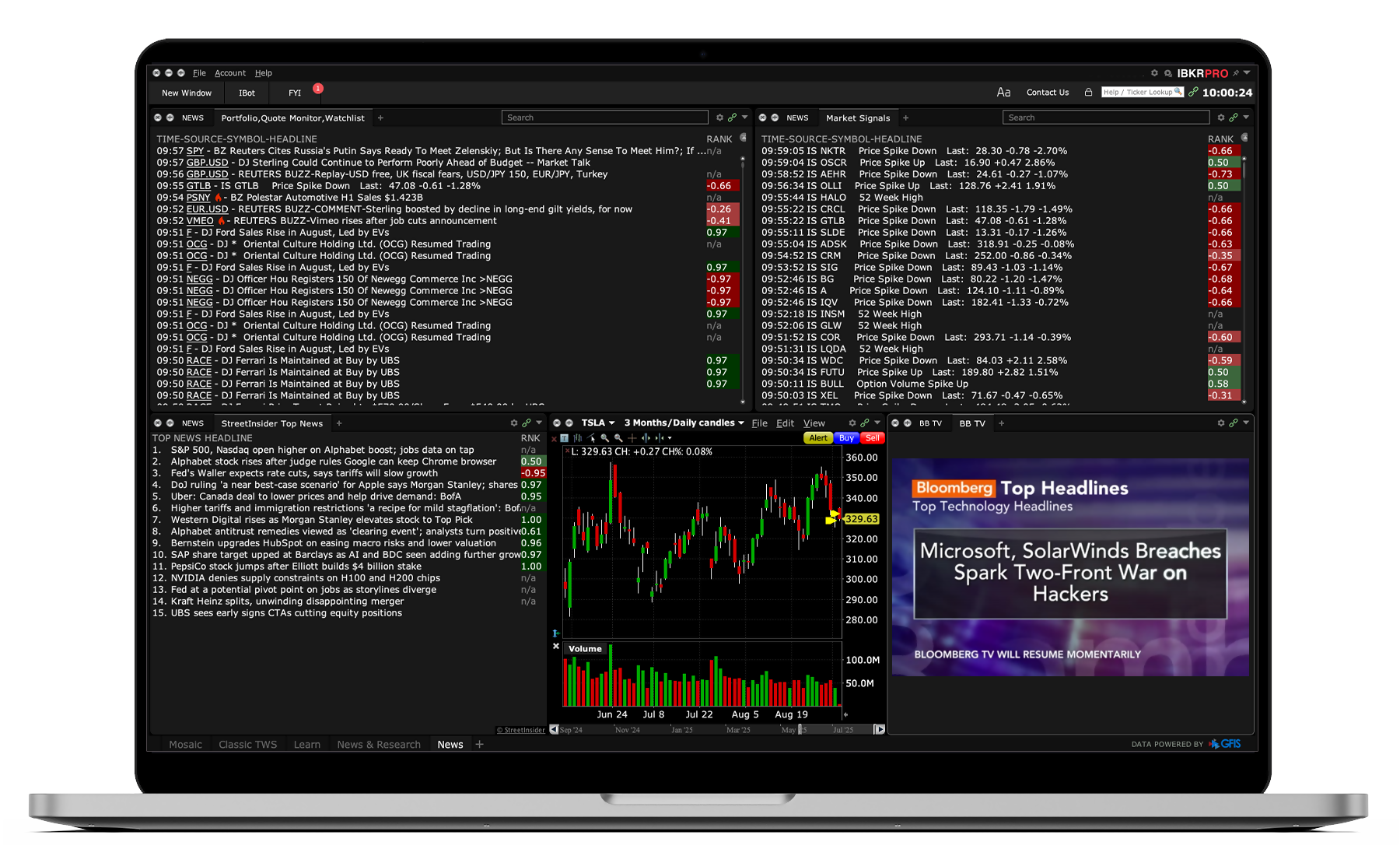

Trader Workstation (TWS)

Our flagship desktop platform designed for active traders and investors who trade multiple products and require power and flexibility.

IBKR Mobile

Easily trade and monitor your IBKR account on-the-go from your iOS or Android device (tablet or smartphone).

What are Contracts for Difference?

Contracts for Difference, or CFDs, let you trade on the price movements of stocks, indices, forex, commodities, and more without owning the actual asset.

You can choose to buy if you think the price will go up or sell if you think it will go down. CFDs are flexible tools that give you access to a wide range of global markets and often allow you to use leverage, which means you can control a larger position with a smaller investment. Instead of buying the asset itself, you trade based on the difference between the opening and closing prices of the position.

How Do I Buy CFDs?

Getting started with CFDs is straightforward. First, open an account with a trusted broker like Interactive Brokers, which offers access to a wide range of global markets and competitive pricing. Once your account is set up, add funds using your preferred payment method. Next, choose the asset you want to trade, such as a stock, index, currency pair, or commodity. If you believe the price will go up, you can buy a CFD. If you think the price will go down, you can sell a CFD. Decide how much you want to trade and, if available, adjust your leverage to control a larger position with a smaller investment. To help manage your risk, you can set optional tools like stop-loss or take-profit orders. After placing your trade, you can monitor the market and close your position at any time.

What Are the Benefits and Risks of Trading CFDs?

CFDs offer both potential rewards and risks. On the reward side, CFDs let you take advantage of rising or falling markets without owning the actual asset. They give you access to global markets and often allow you to use leverage, which means you can control a larger position with a smaller amount of money. However, the risks can be significant. Leverage can increase your losses just as quickly as it can increase your gains. If the market moves against you, you may lose more than your initial investment. CFDs also carry costs such as spreads and overnight fees, and fast-moving markets can make it hard to react in time. Because of these risks, CFDs may not be suitable for everyone, especially new or inexperienced traders.

Interactive Brokers’ Education and Resources for CFDs

Traders’ Academy

Access free online courses that cover the concepts and tools of financial trading. Whether you are an active trader, investor, educator or student, we offer engaging lessons utilizing our award-winning trading tools. Read notes and quizzes to help reinforce each lesson.

IBKR Podcasts

Stay up to date with financial and macroeconomic events by subscribing to the IBKR Podcast channel by Interactive Brokers. Audio market commentary draws upon an array of industry experts to get unique insight on a variety of topics and asset classes. Episodes include discussions with researchers, leading financial services companies and veterans from the financial field.

Start trading like a professional today!

Open AccountDisclosures

- Risk of CFD transaction:

The prices of CFDs will be influenced by, among other things, the market price of the underlying product of the CFD, the earnings and performance of the company or companies whose shares comprise the underlying product or a related index, the performance of the economy as a whole, the changing supply and demand relationships for the underlying product or related instruments and indices, governmental, commercial and trade programs and policies, interest rates, national and international political and economic events and the prevailing psychological characteristics of the relevant marketplace. Trading Contracts for Differences (“CFDs”) is highly risky due to the speculative and volatile markets in these products and the leverage (margin) involved. Trading these products may result in a loss of funds greater than you deposited in the account. - Margin Requirement:

The margin ratio applied to CFD transactions will be 22% for individual clients and 12.5% for corporate clients for the initial margin and 20% for individual clients and 10% for corporate clients for maintenance margin. - The items described on this website are for the purpose of providing general securities investment and not for solicitation. Please make a final investment judgment by yourself. Please be informed that the contents of this website may be changed without advance notice.

- All commissions and fees include the 10% Japanese consumption tax.