Products ETF Trading

PRODUCTS

Trade ETFs Globally from a

Single Screen

The IBKR Advantage

- Low Commissions with no added spreads, ticket charges or platform fees

- Trade ETFs globally

- Professional trading platforms, order types, and tools

- Fractional Shares let you invest regardless of share price

Lower Costs to Maximize Returns1

ETFs Commissions

Low Commissions

USD 0.0005 to USD 0.0035 per share

Tiered or Fixed • No PFOF

Trading Technology

- Free Access to all IBKR's trading platforms

- Free real-time streaming data on all US-listed stocks

- IB SmartRoutingSM

- IBKR APIs

Additional Plan Benefits

- No minimums for general investment accounts

- No inactivity fees

- No added spreads, ticket charges or platform fees

- No recurring fees

Interactive Brokers offers low, simple ETF pricing on most global exchanges. We are simplifying our pricing so you know the cost before you invest.

IB SmartRoutingSM helps support best execution by searching for the best available prices for stocks, options and combinations across exchanges and dark pools.

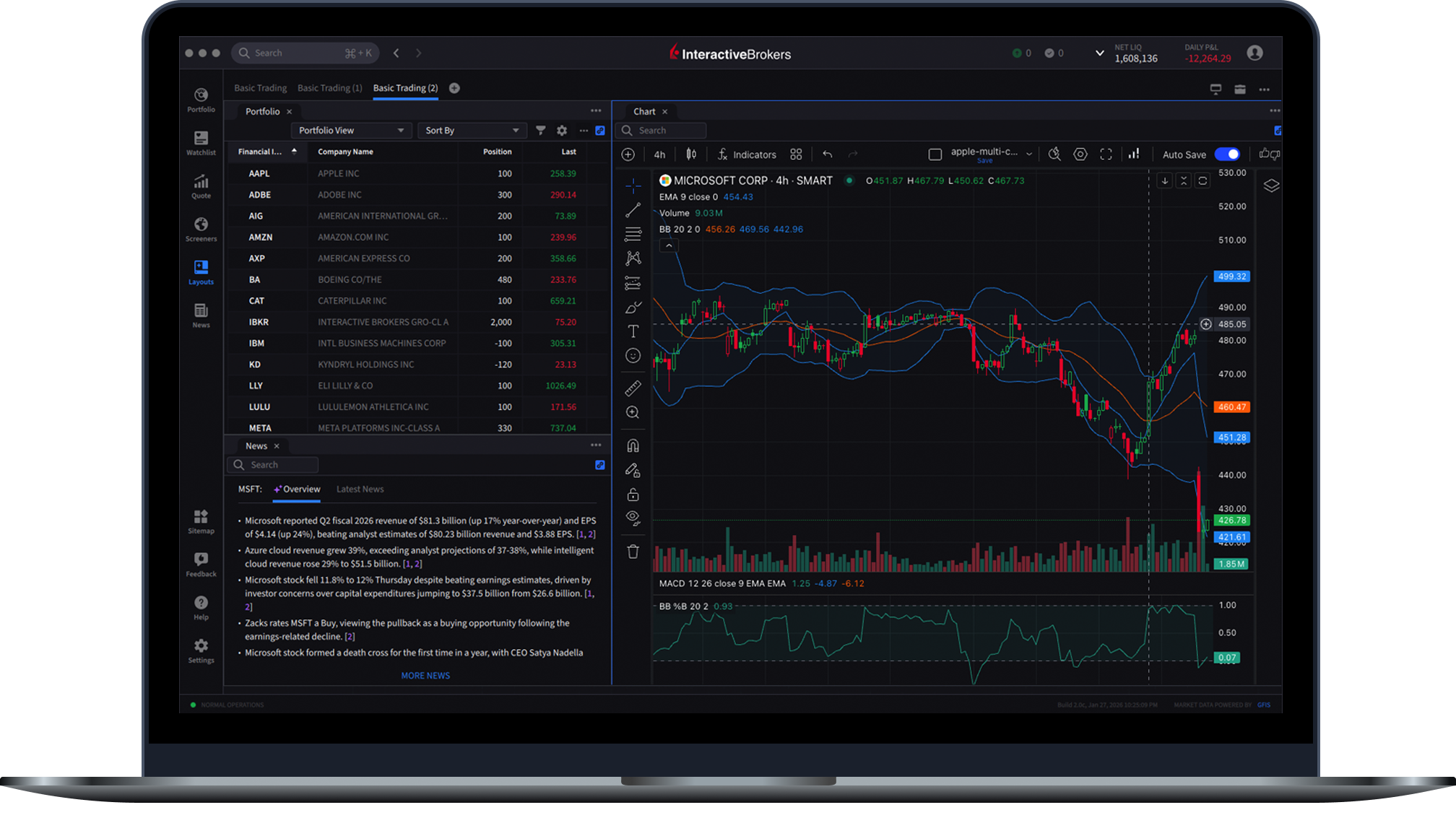

Professional Trading Platforms, Order Types, and Tools

Powerful, award-winning trading platforms and tools for managing your portfolio. Available on desktop, mobile apps, and web.

See Our Trading Platforms80+ order types, algos and tools – from limit orders to complex algorithmic trading – help you execute any trading strategy.

See Our Order Types, Algos and ToolsUse a full suite of professional trading tools to help make better decisions and manage your portfolio. Spot market opportunities with Advanced Market Scanners and analyze your portfolio with Risk Navigator.

See Our Trading ToolsFundamentals Explorer provides comprehensive, worldwide fundamentals data on over 30k companies, shows more than 300 data points per company, has more than 80 sources for newswires and reports and features 5.5k+ analyst ratings from TipRanks.

See Our Fundamentals ExplorerAlign your investments with what you care about most. Use the Impact Dashboard to identify and invest in companies that share your values, and use ESG scores from LSEG to make investment decisions based on more than just financial factors.

Learn About Sustainable Investing

What Are ETFs?

Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges like an individual stock. Each ETF typically holds a diversified portfolio of assets such as stocks, bonds, or commodities, and is designed to track the performance of a specific index, sector, or theme.

Why Invest in ETFs?

ETFs offer a cost-effective way to build a diversified portfolio.

Key benefits include:

Low Cost

ETFs will generally have lower fees than mutual funds.

Diversification

A single ETF can provide exposure to dozens or

hundreds of securities.

Liquidity

ETFs can be bought and sold throughout the trading

day at market prices.

Transparency

Most ETFs disclose holdings daily, so investors

know what they own.

However, ETFs (like all financial products) have risks such as:

- Market Risk: Like stocks, ETFs can lose value due to changes in market conditions, interest rates, or economic factors.

- Tracking Error: Some ETFs may not perfectly mirror the performance of their target index due to fees, trading costs, or replication methods.

- Liquidity Risk: Not all ETFs are highly traded. Lower trading volume can lead to wider bid-ask spreads or price inefficiencies.

- Product Complexity: Leveraged, inverse, or synthetic ETFs carry unique risks that may not suit all investors.

- Currency & Regional Risks: International ETFs may be affected by currency fluctuations or geopolitical events.

Interactive Brokers’ Education and Resources About ETFs

Traders’ Academy

Traders’ Academy by Interactive Brokers provides complimentary resources to educate you on ETFs, including the following courses:

ETF Liquidity Considerations

ETF shares can trade in the secondary market at a premium or discount to their Net Asset Values, which can create a catalyst for creations or redemptions. However, the secondary market accounts for a limited portion of an ETF’s overall liquidity.

ETPs at a Glance

An exchange-traded product (ETP) is a financial instrument traded on a regulated stock exchange. It is designed to replicate the return of an underlying benchmark or asset before fees, with the easy access and tradability of a share. Exchange-traded products offer investors access to a whole universe of exposures, from traditional asset classes like equities and bonds to alternatives like commodities and currencies, once only accessible for institutional investors.

Start trading like a professional today!

Open AccountDisclosures

- Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.