Broker

Introducing Brokers

Prime Broker services to help you efficiently manage your business and serve clients

The IBKR Advantage

- A turnkey solution for Prime Brokers covering trading, clearing, reporting, and billing – with no long-term contract required.

- Access powerful trading technology and advanced trading tools to trade stocks, options, futures, currencies, bonds and funds on over 50+ markets in 17 countries and 12 currencies.

- Pre-trade compliance, real-time market-risk management and monitoring provide a comprehensive measure of risk exposure.

- Lower your costs – no ticket charges, no minimums and no technology, software, platform, or reporting fees.

- Transparent, low commissions and financing rates and access to the IB SmartRoutingSM system, which provides .1

- Free client relationship management tools to help you efficiently manage clients.

- Support for global regulatory reporting including FATCA, MiFID II, AML, GDPR and others.

- Market your services in the Investors’ Marketplace.

- Full white branding and custom website creation services.

Flexible Client Management

Our Broker Portal is a powerful client relationship management (CRM) system for brokers.

Integrated Client Management

- Manage the complete client acquisition and relationship lifecycle.

- Use Client Data Queries to generate reports to segment and analyze your client base.

- Quickly and easily consolidate financial information from any financial institution with PortfolioAnalyst, a fully featured portfolio management tool.

Efficient Design

Use simplified workflows, logically grouped menus and user access rights to efficiently manage your relationships from any desktop or mobile device.

Reliable Client Onboarding Processes

IBKR offers multiple options for adding clients and migrating to our platform, including fully- and semielectronic account applications, a mass upload feature and support for customized client account applications using our application XML system.

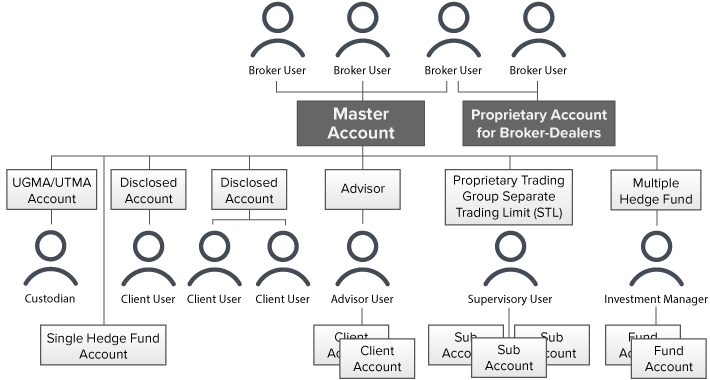

Manage User Access Rights

Set up enhanced user access and account security by creating one or more Security Officers for the master account and designate up to 250 users by function or account.

Flexible Client Billing

Use our CRM to implement flexible fee structures, automate fee administration and provide dynamic fee management.

Commission Markups

- Charge clients for services rendered based on a fee-per-trade unit for each asset class, exchange and currency. The trade unit is determined by the unit IBKR uses for its commissions charges and can be on a per share, per contract, or percent of trade value basis.

- Apply client fee schedules to individual accounts or store them in templates.

- Easily maintain different fee schedules for multiple client accounts.

Electronic Invoicing

- Automatically submit client fee invoices.

- Set maximum invoicing amounts or percentage caps.

- Meet your compliance obligations by notifying your clients of advisory fee details.

Interest Markups and Markdowns

- Mark down credit and short proceeds credit interest and mark up debit interest. Markups and markdowns are entered as percentages with 8 fields available for input.

- Charge markups to clients based on IBKR stock borrow rates, entered as a variable or fixed percentage of our borrow rate. You can enter both types of markups and our system will apply the markup rate that results in the larger total amount.

Caps and Limitations

- Client markups by introducing brokers are limited to 15 times IBKR's highest tiered rate plus external fees.

- For US stocks, the highest tiered rate would be USD 0.0035 per share. USD-denominated bonds are subject to a separate cap on markups. US option markups are limited to 10% of trade value.

- Limits are subject to change, and specific products may have an additional limit in place.

- No markups are applied if the client calls IBKR to close a trade.

Trading Technology to Help Introducing Brokers Succeed

Trading Platforms

Powerful, award-winning trading platforms and tools for managing client assets. Available on desktop, mobile, web and API.

Order Types and Algos

100+ order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

API Solutions

Our proprietary API and FIX CTCI solutions let institutions create their own automated, rules-based trading system that takes advantage of our high-speed order routing and broad market depth.

Sophisticated Risk Management

Understand risk vs. returns with real-time market risk management and monitoring that provides a comprehensive measure of risk exposure across multiple asset classes around the world.

Securities Financing

From trade date to settlement date, our Securities Financing solutions provide depth of availability, transparent rates, global reach and automated lending and borrowing tools.

Advanced Trading Tools

Spot market opportunities, analyze results, manage your account and make informed decisions with our free advanced trading tools.

Comprehensive Reporting

Our statements and reports cover real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis, tax optimization and more.

インベスターズ・マーケットプレイス

600+

投資

サービス

320+

リサーチ

サービス

450+

テクノロジー

サービス

200+

管理

サービス

40+

事業開発

サービス

インベスターズ・マーケットプレイスでは個人のトレーダーや投資家、機関、またサードパーティ・サービスプロバイダーがお互いに交流し、ビジネス展開につなげることができます。

アドバイザーやブローカー、ウェルスマネージャーを検索してビジネスを始めてください。インタラクティブ・アドバイザー提供のスマートベータ・ポートフォリオを含める様々なポートフォリオをご利用いただけます。認定投資家または適格購入者のお客様はヘッジファンドを検索して投資することができます。

- ご自身のサードパーティ・サービスを個人や機関投資家にマーケティングすることができます。

- APIやFIX CTCIソリューションを提供するサードパーティ・ベンダーを見つけてください。

- サードパーティの機関リサーチプロバイダーを検索し、トレーダー・ワークステーション(TWS)から直接リサーチにアクセスすることができます。

信用できる証券会社

お客様の資金を証券会社に預け入れる際は、その会社が安全で、金融市場の好不況に左右されない耐久力をもっていることを確認する必要があります。当社は、その強固な資本基盤と財務状態、自動化されたリスク管理体制により、万一金融機関の安定性を損ないうる重大な事態が市場で起こっても、グループ全体が守られるように設計されています。

インタラクティブ・ブローカーズ証券株式会社は、インタラクティブ・ブローカーズ・グループの子会社です。

IBKR

Nasdaq上場

$161億

自己資本*

74.6%

個人所有*

$104億

自己資本余力*

312万

クライアント口座*

235万

1日の標準取引高*

IBKR保護

*インタラクティブ・ブローカーズ・グループとその関連会社。追加情報に関しましては、当社の「投資家情報」-「決算発表」をご覧ください。

Introducing Broker Account Structure

Open an Introducing Broker Account

Broker accounts at Interactive Brokers give global regulated brokerage companies the means to reduce their operational, brokerage and clearing costs while providing electronic market access worldwide with our professional white branded trading technology.

米国財務省外国資産管理局による制裁対象リストやその他同類のリストに記載される国と地域、またはリスクが高いとみなされるその他の国を除き、すべての国の住民の方に口座をご開設いただけます。お取引可能な国をご覧ください。

Please note that monthly activity and other minimum fees may apply.

For information on SIPC coverage on your account, visit www.sipc.org or call SIPC at

(202) 371-8300.

Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section by clicking here.

- Based on independent measurements, IHS Markit, a third-party provider of transaction analysis, has determined that Interactive Brokers' US stock price executions were significantly better than the industry's during the first half of 2020. For more information, see ibkr.com/bestexecution.